TDS & TCS on Non filing of IT Returns

Introduction

With the intent to penalise the non-filers of the income tax returns, CBDT introduced new sections, namely, 206AB and 206CCA.

Section 206AB (Clause 51 of Finance Bill 2021)

Any person who is liable to deduct tax at source on any sum paid/payable to a Specified person shall hereafter deduct tax at the highest of the following

- Twice the rate specified in the act or rates in force;

- at the rate of five percent

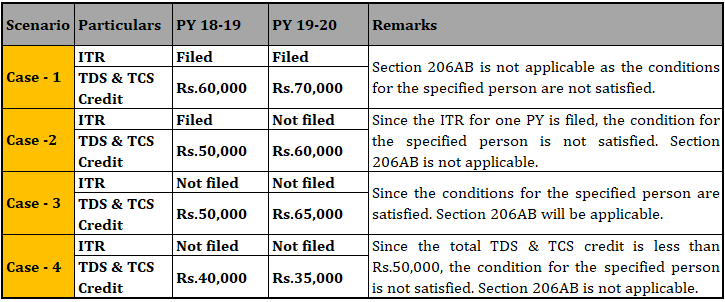

Illustration for applicability of the section:

Explanation

- For the purpose of this section, “Specified Person” means a person

- who has not filed the Returns of Income for both of the two Assessment years whose returns filing period under section 139(1) has expired and;

- Whose total TDS & TCS in each of those two previous years is Rs.50,000 or more.

- A specified person shall not include a non-resident who does not have a permanent establishment in India.

- Tax is required to be deducted at the highest of twice the applicable rates or the rate of 5 % on any sum (subjected to the provisions of TDS) paid/payable to aforementioned Specified Persons.

- The provisions of this section shall not apply where tax is deducted under the following sections:

- Section 192 -Salary

- Section 192A -Premature withdrawal from EPF

- Section 194B -Lottery winnings

- Section 194BB -Horse race winnings

- Section 194LBC-Investment in Securitization fund

- Section 194N -Cash withdrawals in excess of Rs.1 Cr.

- In case the “Specified Persons” does not furnish PAN to the person liable to deduct tax, then the tax shall be deducted at the highest of the following:

- at the rates mentioned in this section;

- At the rates mentioned in section 206AA (i.e. highest of applicable rates or 20%)

Section 206CCA (Clause 52 of Finance Bill 2021

Any person who is liable to collect tax at source on any sum receivable from a Specified person shall hereafter collect tax at the highest of the following:

- twice the rate specified in the act;

- at the rate of five percent.

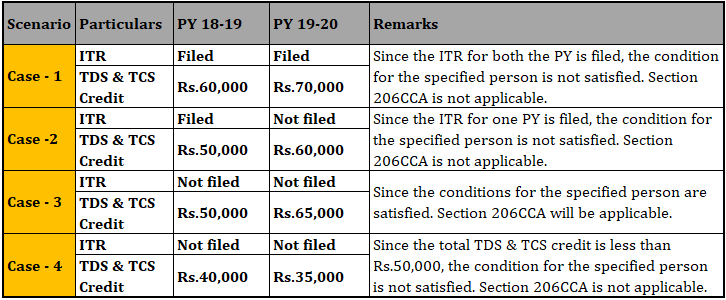

Illustration for applicability of the section:

Explanation

- For the purpose of this section, “Specified Person” means a person

- who has not filed the income tax returns for both of the two previous years whose returns filing period under section 139(1) is expired and;

- Whose total TDS & TCS in each of those two previous years is Rs.50,000 or more.

- A specified person shall not include a non-resident who does not have a permanent establishment in India.

- Tax to be collected at the highest of twice the applicable rates or the rate of 5% on any sum (subjected to the provisions of TCS) receivable/received from aforementioned Specified Persons

- In case the “specified person” does not furnish PAN to the person liable to collect tax, then the tax shall be deducted at the highest of the following:

- at the rates mentioned in this section;

- at the rates mentioned in section 206CC (i.e. higher of twice the applicable rates or 5%)

Applicability

Both sections 206AB and 206CCA will be applicable from 1st July 2021.

Compliance

As per the latest circular issued by CBDT, a new functionality “Compliance Check for Sections 206AB & 206CA” has been introduced in Income Tax Portal to ease the compliance under sections 206AB & 206CCA. By feeding PAN of deductee in this functionality, one can know whether such deductee is a Specified Person or not for the purpose of these sections.

Frequently Asked Questions (FAQs)

- When will Sections 206AB and 206CCA be implemented?

Sections 206AB and 206CCA have been newly inserted by the Finance Act 2021 and will be applicable from 1st July 2021.

- What happens if the provisions section 206AB & section 206CCA have not complied?

The Income Tax Law levies penalties for non-compliance with the TDS provisions under Section 201A. Also, late filing of TDS returns will be penalised.

The tax deductor will face the following consequences, if they fail to deduct TDS as per the provisions: disallowance of expenditure, interest on late payment, and penalties.

- Which years are relevant for FY 2021-22 based on the definition of “Specified person”?

As of 1st July 2021, the time limit for filing Income-tax returns under section 139(1) is expired only for FY 2018-19 and FY 2019-20 in case of all the types of taxpayers, and as such the due date for FY 2020-21 is not expired. Therefore, FY 2018-19 and FY 2019-20 are relevant PYs for checking the applicability of the sections as of 1 July 2021.

- What if the tax deductee has filed ITR for only one year instead of two?

Such a Deductee would not be treated as “Specified person” since the definition of “Specified person” is triggered only when the Deductee has not filed the tax return for both the two previous years. Given this, technically the provisions of section 206AB and 206CCA should not be applicable in such cases.

- Do Sections 206AB and 206CCA apply if the tax to be deducted /collected is less than Rs.50,000?

The threshold of Rs.50,000 TDS/TCS is for the entire income of the deductee and not just a part of income credited by a particular tax deductor. Hence, the total TDS/TCS in Form 26AS of the recipient should be considered.

Disclaimer:

The Information provided in this document does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available in this document are for general informational purposes only, prepared based on relevant Income tax provisions and information available on the period of preparation.