TDS on Purchase of Goods – S.194Q

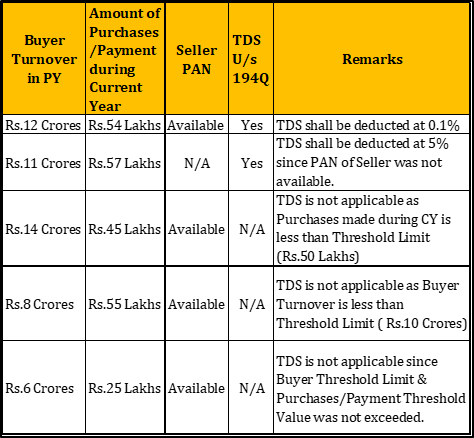

Any person, being a buyer who is responsible for paying any sum to any resident (seller) for purchase of any goods of the value or aggregate of such value exceeding 50 lakh rupees in any previous year, shall, at the time of credit of such sum to the account of the seller or at the time of payment thereof by any mode, whichever is earlier, deduct an amount equal to 0.1 per cent (5% if PAN is not provided) of such sum exceeding fifty lakh rupees as income-tax.

Applicability (Applicable from 1.7.2021)

- For the purposes of this sub-section, “buyer” means a person whose total sales, gross receipts or turnover from the business carried on by him exceed Rs.10 Crore during the financial year immediately preceding the financial year in which the purchase of goods is carried out.

- Tax is required to be deducted by such person, if the purchase of goods by him from the seller is of the value or aggregate of such value exceeding Rs.50 Lakhs in the previous year

- If a transaction TDS or TCS is required to be carried out under any other provision, then it would not be subjected to TDS under this section. However once exception to this rule is, if a Transaction attracts TCS under Section 206C (1H) as well as TDS under this Section, then TDS shall be applicable for such a transaction.

Illustration

Comparison between S.194Q and S.206C (1H)

Practical FAQ

1. Date from which this section applicable?

Sec 194Q is applicable from 1. July 2021.

2. What if, seller is liable to collect TCS under sec 206C (1H) and buyer is liable to deduct TDS under sec 194Q?

Section 194Q shall override section 206C (1H). Hence in such a case only buyer is required to deduct TDS and seller need not collect TCS under sec 206C (1H).

Example – Mr. Seller Sold goods to Mr. Buyer and collecting TCS under section 206C (1H), However as per Section 194Q, Mr. Buyer is covered by Section 194Q. Since section 194Q is overriding section 206C (1H). Hence Mr. Buyer shall be liable to deduct TDS under this section and Mr. Seller need not collect TCS under sec 206C (1H).

3. What if payment is made in advance on 31st May 2021 and invoice received on 2nd July 2021?

Ans. Since this point of taxation arises on before 1st July 2021 (i.e., 31st May 2021), hence TDS shall not be liable on such transaction.

4. Purchasing Limit for 50Lakhs to be check from 1April, 2021 or 1 July, 2021?

For purchasing limit of Rs. 50 Lakhs Sec 194Q clearly mentioned PREVIOUS YEAR, hence purchasing limit of Rs. 50Lakhs to be consider from 1 April, 2021 and not from 1 July, 2021.

5. If Purchase amount exceed 50 Lakhs, then TDS to be calculated on complete amount or amount exceeding 50 Lakhs?

For Example, Mr. Buyer buy goods from Mr. Seller amounting Rs. 95 Lakhs and he is liable to deduct TDS under section 194Q. Now in this case TDS to be deduct on Rs. 45 Lakhs (95-50 Lakhs) @ 0.1%.

6. Due date of payment of TDS?

7th of following month

7. TDS Return

This deduction details shall be incorporated in Form 26Q which shall be filled quarterly.

Disclaimer: The Information provided in this Document does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available in this document are for general informational purposes only, prepared based on relevant Income tax provisions and information available on the period of preparation.