Merger and Acquisition : Recent trends in India

Mergers & Acquisition: Recent Trends in India

Introduction

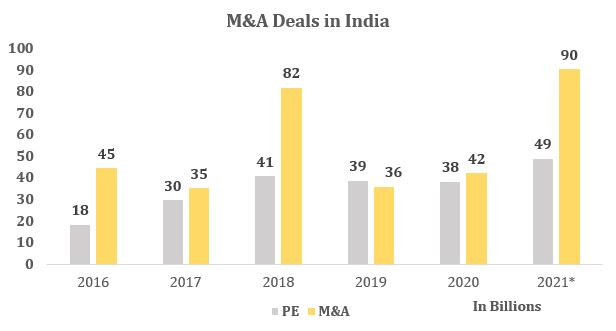

Mergers and Acquisition has been in the raise for the past 5 years in India, according to a Report there were more than 15,000 deals took place between 2015 to 2021 which were worth more than 545 billion dollars

*up to September

The revolutionary insolvency Bankruptcy code 2016 have also paved a way for increased M&A in India.

The increase in M&A deals under the code is undeniable and quite evident as per the reports, till 2018, the M&A deals in distressed assets worth USD 14.3 billion were done in just 2 years of operations of the code.

Distressed M&As has accounted for about 3% of the total M&A volume in the Indian market and 21 out of a total 623 deals completed since 2017.

Now let’s understand what M&A mergers and Acquisitions, Contrary to popular belief Mergers & Acquisition are not the same they have different meaning attached to it.

Mergers Acquisitions

Merger

Merger is combination of two separate entities combine’s forces to create a new joint organization. A soon as new joint entity is formed the other entities involved in this process lose their existence example are merger of Vodafone with idea to form Vodafone idea.

Acquisition

Acquisition on the other hand are done by strong companies that take over other companies and the target co will lose its existence example acquisition of uber eats by Zomato.

Whenever the Acquiring Company takes over or merges with the target company the acquiring company has to pay some consideration to the target co in form of cash, Equity. This process of M&A is called M&A financing.

Which is the process of raising money to fund mergers and acquisitions. The primary sources of mergers and acquisitions are Equity and debt companies may at times use cash incase it has huge reserves Example acquisition of sunrise food by ITC for 2150 core by cash.

Equity Financing

Equity financing on M&A means two things we are selling equity of the company to raise cash to fund the M&A or we are using a stock swap which means we are allotting shares of our company to target company (selling co) shareholders based upon an exchange ratio.

The seller’s co shareholders get opportunity to gain from the combined business future gain.

The advantage of using equities is that we don’t burn through cash and it doesn’t need to be repaid, no commitment to pay interest but on the flipside Equity financing is more expensive to debt.

Required rate of return are high for equity financing which leads to loss of control over the company, the net income of the co will increase as a result of synergy (increase in productivity as a result of M&A) but Earnings per share (EPS) of the company would be decreased as a result of equity financing.

Debt Financing

Debt financing means raising money from lenders to borrow money to fund M&A. It might be difficult to raise fund as a startup or less mature companies at low rates. The advantage of debt financing is that it is cheaper alternative compared to equity and also it gives tax-savings benefits and it doesn’t dilute the equity which means investors get more return and enjoy synergy benefits without losing.

Recent M&A trends in India

The COVID-19 pandemic caused significant uncertainty in 2020, further compounded by global trade tensions, regulatory pressures, geopolitical issues and the US presidential transition. However, deal activity in 2021 nearly retained momentum with the previous year despite these challenges.

First 9 months of 2021 has shown resilience with 90.4 Billion dollars That is a 35% increase compared to the last year of same period.

The deal count went up by 10.1% year on Year, Average deal value during the first nine months of 2021 totalled $105 million.

The Domestic M&A activity amounted to $34.5 billion dollars up 14% compared to last year. The largest of this domestic deal is acquisition of Dewan housing finance crop by Piramal capital& housing which contributed to 4.7 Billion dollars.

The US was the most active foreign acquirer in India with $20.3 billion worth of deals, up 19.3% from a year ago and accounted for 41.7% market share of India’s inbound M&A.

Majority of the deal-making activity involving India targeted the financial sector which totalled $21.9 billion in deal value, Energy and power accounted for a value to $13.7 billion, High technology, which saw the highest number of deals, accounted for a value $12.7 billion.

On the other hand, Indian equity capital markets (ECM) raised $22.1 billion during the first nine months of 2021, Indian M&A area looks to make a recovery the disinvestment from non- core business being a key driver. The new budget signals the government’s intention to disinvestments of key public sector company’s which would boost the investment prospect in the country.

The Top 4 M&A in 2020

ITC acquisition of Sunrise food

1)The Diversified business entity ITC has acquired spice manufacturer Sunrise food for a consideration of 2150 crores which was too paid by cash. Sunrise Foods Private Limited is a Kolkata-based family-owned company engaged primarily in the business of spices, and this acquisition would help ITC augment its portfolio in the segment where it is present with its brand Aashirvaad.

Zomato acquisition of Uber eats

2) The online food delivery giant Zomato has acquired the Uber’s food delivery business, ‘Uber-Eats’ for a deal value of around USD 350 million. In this all-stock deal.

As per this deal uber has been allotted a 10 % stake in Zomato foods this is a win- win situation for both the parties as uber eat was piling up in losses and they were looking for a buyer And for Zomato it has eliminated its Competition which had a market share of around 12% now it left with only one competitor.

Reliance acquisition of Vitalic Health Pvt

3) Reliance has been in the headline for majority of the year for either selling its stake to foreign companies or acquiring small companies to expand their market size this time it has acquired majority equity stake in Chennai-based Vitalic Health Pvt Ltd and its subsidiaries (collectively known as ‘Netmeds’) for approximately ₹620 crores this deal is done through full cash.

Hindustan unilever merger with Gsk

4) Hindustan Unilever Limited (HUL), one of India’s leading consumer goods companies, has successfully merged with GlaxoSmithKline (GSK) Consumer Limited. The deal gave HUL the rights to distribute GSK’s brands, the prominent ones being Crocin, Eno, Sensodyne, etc. in India.

As a result of the Merger, GSk’s 3,500 employees joined HUL. After the completion of the deal, GSk will own a 5.7% stake in the merged company. Post the Merger, Unilever’s stake in the merged entity shall be 61.9%. The merger of GlaxoSmithKline Consumer Healthcare Limited with HUL has been on the basis of an exchange ratio of 4.39 HUL shares for each GlaxoSmithKline Consumer Healthcare Limited share. No cash was involved.