Government Incentives summary for a consumer electronic manufacturing

Government Incentives Summary for a Consumer Electronic Manufacturer

Introduction

“To improve is to CHANGE, to be Perfect is to CHANGE OFTEN” stated Winston Churchill, the former Prime Minister of United Kingdoms. In the history of human progress, there are few prominent events that changed and upgraded the human lifestyle such as the use of fire, the invention of agriculture, the Industrial revolution, etc. Of all, the biggest change ever happened to humankind is Technology. Over the years, technology has revolutionized our world & daily lives by adding a lot of multi-functional brand-new devices perennially.

Electronic devices were part of it which have become an important part of our day-to-day life. It has become practically impossible for us to live and work without using an electronic device. Recognizing the increased adoption of consumer electronics in India, the Government of India has come up with considerable incentives and benefits for the manufacturers of Consumer Electronics intending to encourage home-grown products in line with Make-in-India initiative. These schemes focus on incentivising Manufacturers of Electronic goods for their own growth at both micro and macro level.

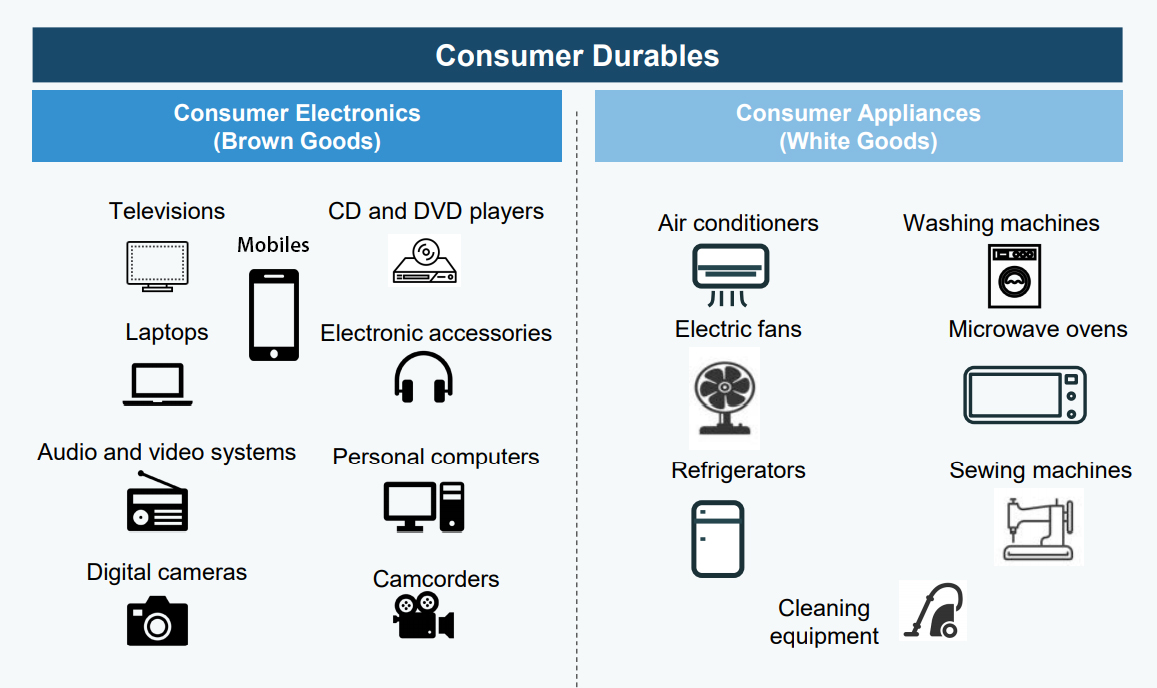

Consumer Durable Products :

Consumer durable Industry is split into two key segments and consists of following products:

Incentives applicable to Consumer Electronic Manufacturers

Consumer Electronic Manufacturer can take any of the following forms in India and avail below mentioned incentives.

- As an Electronic Hardware Technology Park (EHTP) Unit

- As a Special Economic Zone Unit

- As a unit in other areas.

| Particulars | As an EHTP Unit (100% Export Oriented Unit) | As a Special Economic Zone Unit | Operating in any other areas (Domestic Tariff Area Unit) |

| Eligibility | All the items of Consumer electronic products are covered under Electronic Hardware Technology Park Scheme (EHTP Scheme). The EHTP Scheme is a 100% export-oriented scheme for the development and export of electronics hardware. | Any private/public/joint sector or State Government or its agencies can set up Special Economic Zone (SEZ) including Electronic Manufacturer | Electronics manufacturing can be established in any other areas of India. |

| Procurement of goods | |||

| Import of Goods | Basic Customs Duty – Exempt Additional Customs duty – Applicable IGST & Compensation cess – Exempt | Any duty of Customs – Exempt GST & Applicable cess – Applicable | Customs Duty & IGST & Applicable Cess – Applicable |

| Domestic procurement of goods | GST & Applicable cess – Applicable but can claim refund (Deemed export) | Customs duty & GST – Exempt* (since treated as exports) | GST & Applicable cess – Applicable |

| Supply of Goods | |||

| Export of Goods | Export duty – Exempt GST & Applicable Cess – Exempt* (Zero rated supply) | GST & Applicable Cess & Export duties – Exempt* | GST & Applicable Cess & Export duties – Exempt* |

| Supplies to Domestic Tariff Area (DTA) units | GST & Applicable cess – Applicable (Along with reversal of Exempted Basic customs duty on such inputs) | GST & Applicable Cess – Exempt* (Considered as Export by SEZ) | GST & Applicable Cess – Applicable |

| Supply to Other EHTP unit | GST & Applicable cess – Applicable (Along with reversal of Exempted Basic customs duty on such inputs) | – | GST & Applicable Cess – Applicable But refund can be claimed (Since Deemed exports) |

| Supply to Other SEZ unit | – | IGST & Applicable Cess – Applicable (Considered as Inter state supply) | IGST & Applicable Cess – Exempt* (Zero rated supply) |

| Income Tax | |||

| Income tax | Tax holiday has ended. However, can avail benefit of reduced taxation at 17.16% if other mentioned benefits as per Income Tax Act are not availed. | Tax holiday has ended. However, can avail benefit of reduced taxation at 17.16% if other mentioned benefits as per Income Tax Act are not availed. | Can avail benefit of reduced taxation at 17.16% if other mentioned benefits as per Income Tax Act are not availed. |

| Other Incentives | |||

| RoDTEP Scheme (Refund rate ranges from 0.5% to 4.3%) for exports | Not Applicable | Not Applicable | Applicable |

| EPCG Scheme (Can import Capital goods on payment of concessional 3% customs duty) with export obligation. | Applicable | Applicable | Applicable |

| Advance Authorisation (Benefit of non-payment of any kind of customs duty as well as IGST at the time of import) with export obligation | Applicable in due course (Past export performance of 2 years required) | Applicable in due course (Past export performance of 2 years required) | Applicable in due course Past export performance of 2 years required. |

| Duty Free Import Authorisation (Benefit of non-payment of Basic customs duty only) with export obligation. | Applicable on Post-export basis. | Applicable on Post-export basis. | Applicable on Post-export basis. |

| PLI – Production linked Incentive | Currently, it is not applicable for Television manufacturing. Government may consider PLI scheme for televisions in future. However, for mobiles phones and specified electronic products, it is applicable. Previously, the base year was FY 19-20. Now the base year has been moved to FY 20-21 for Mobile phones. This benefit can be availed by Manufacturers for incremental sales of goods manufactured in India if the Government relaxes applicable conditions in future. | ||

| SPECS – Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors | For Manufacturing of Electronic Components, Semiconductors, Specialized Sub-Assemblies and Capital Goods, Incentive of 25% on Capital Expenditure pertaining to plant, machinery, equipment, associated utilities and technology, including Research & Development on reimbursement basis in new units as well as Expansion of Existing Units. SPECS will be open for applications for 3 years. Investments made within 5 years from the date of acknowledgement will be eligible for receiving incentive. | ||

| EMC 2.0 – Modified Electronics Manufacturing Clusters Scheme | Electronic Manufacturing Company Projects: Financial incentives of up to 50% of project cost will be awarded, subject to a ceiling of INR 70 crore for every 100 acres of land Minimum Land area: 200 Acres/100 acres for North-Eastern States, Hill States, UTsOverall ceiling: INR 350 Crore per Project Expansion-Related Projects: Minimum Land Area: 100 acres adjoining (50 acres adjoining for North-Eastern States, Hill States, UTs) Common Facility Centres: 75% of the project cost will be awarded, subject to a ceiling of INR 75 crore |

Note:

* Exempt in case of GST & Applicable cess here means Zero rated which has 2 options

- Supply under bond or LUT without payment of IGST and claim credit of ITC; or

- Supply on payment of IGST and claim refund of taxes paid.

Acronyms Used :

- IGST – Integrated Goods and Services Tax

- GST – Goods and Services Tax

- RoDTEP – Remission of Duty or Taxes on Export Products scheme

- EPCG – Export Promotion Capital Goods Scheme

- LUT – Letter of undertaking

- ITC – Input Tax Credit

To conclude:

It has not been easy for an entrepreneur to encounter phenomenal and consistent growth since the beginning. Today, it has become even more complex task and Entrepreneurs face many challenges in today’s ultra-competitive business world. But the difference between the situation few decades ago and now is that Government is encouraging and incentivising the manufacturers for them to expand and diversify into potential sectors & unlock their value of business.

With COVID, people realized that large amount of time is being spent on household chores and understood the need to spend time with family, self-development and professional activities. Hence, People are likely to invest in technologically superior products which ease their lives and are also looking for energy efficient products since work from home culture is being continued in new normal.

Home grown products are gaining traction and Indian brands shall be Self-reliant, Government deliberated.

Businesses shall plan with their Finance and Tax Consultants to comprehend the scheme and realize optimum level of incentives as applicable.