Recent Trends in SME IPO

The report provides a comprehensive analysis of the current landscape and emerging trends in the SME IPO market in India. It covers various aspects, including market overview, key trends, growth statistics, market drivers, and the roles of different stakeholders involved in the SME IPO process.

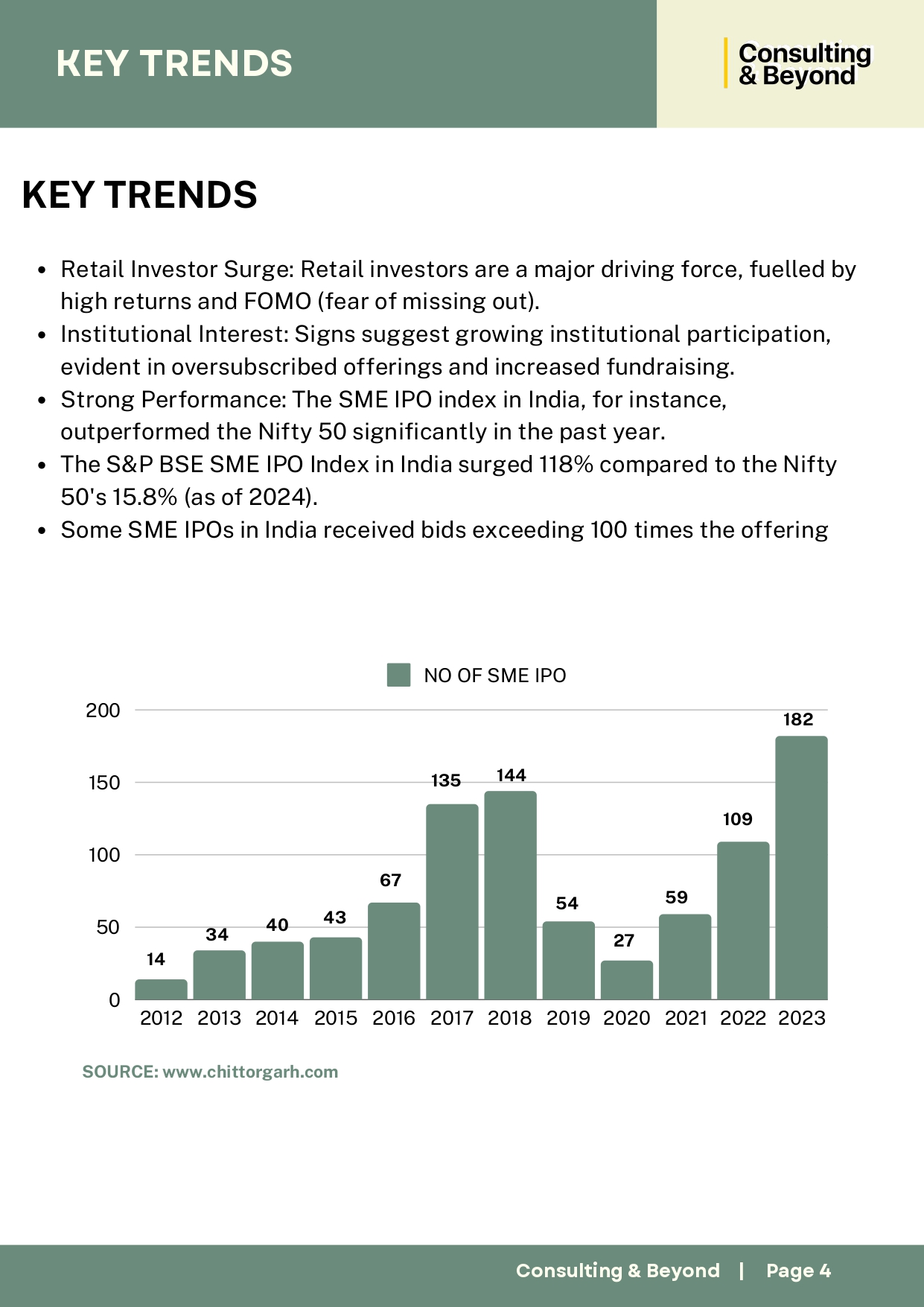

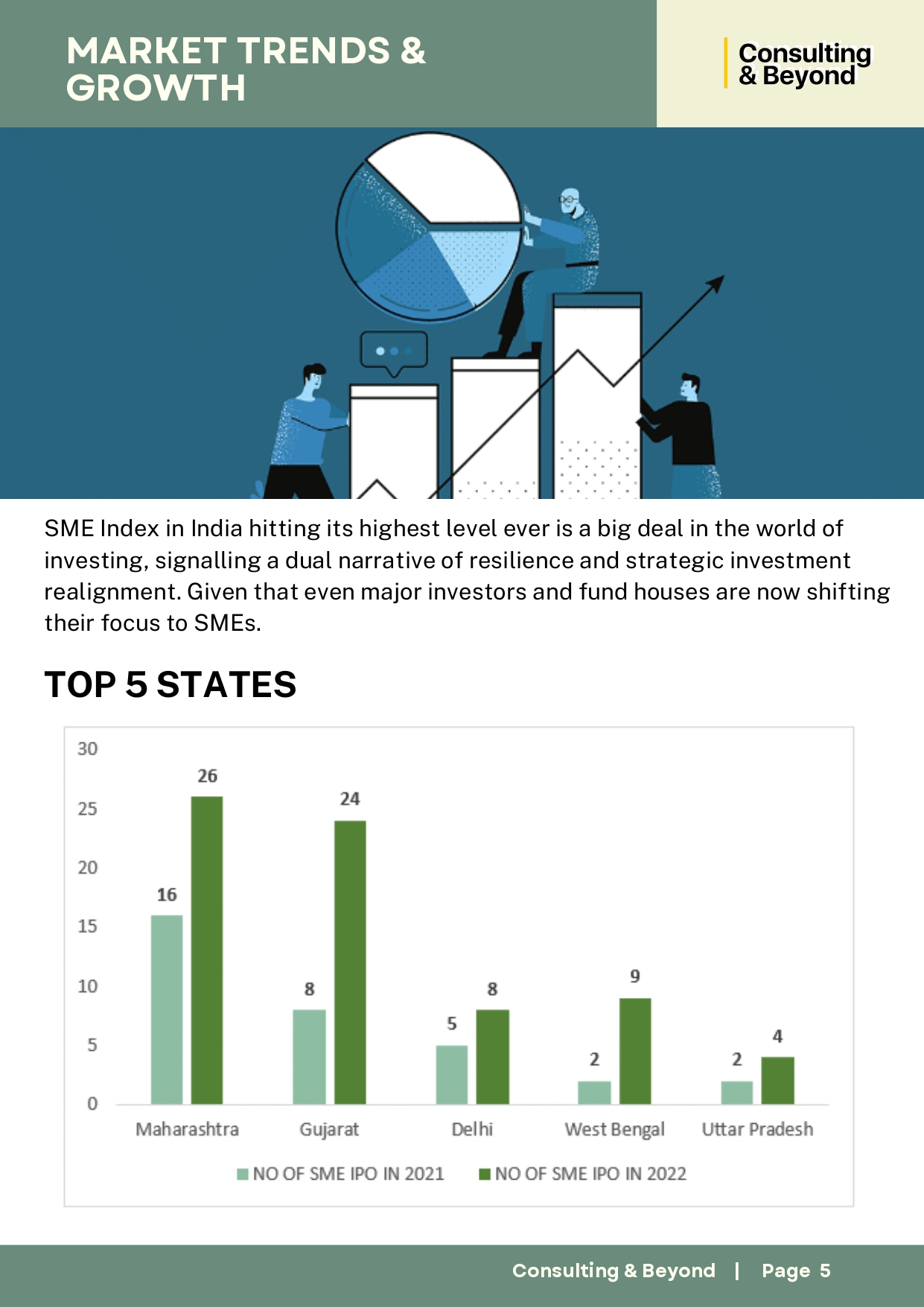

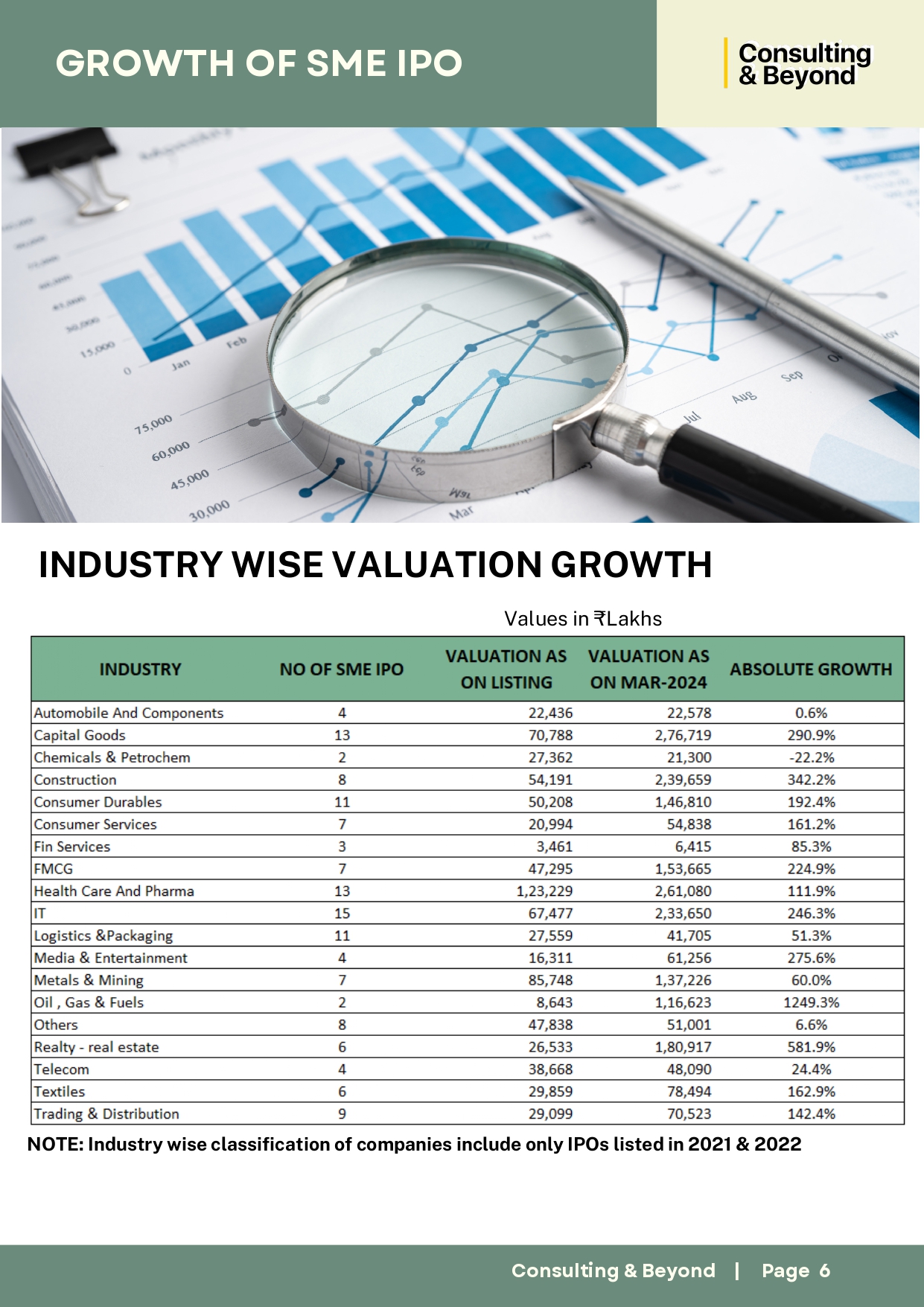

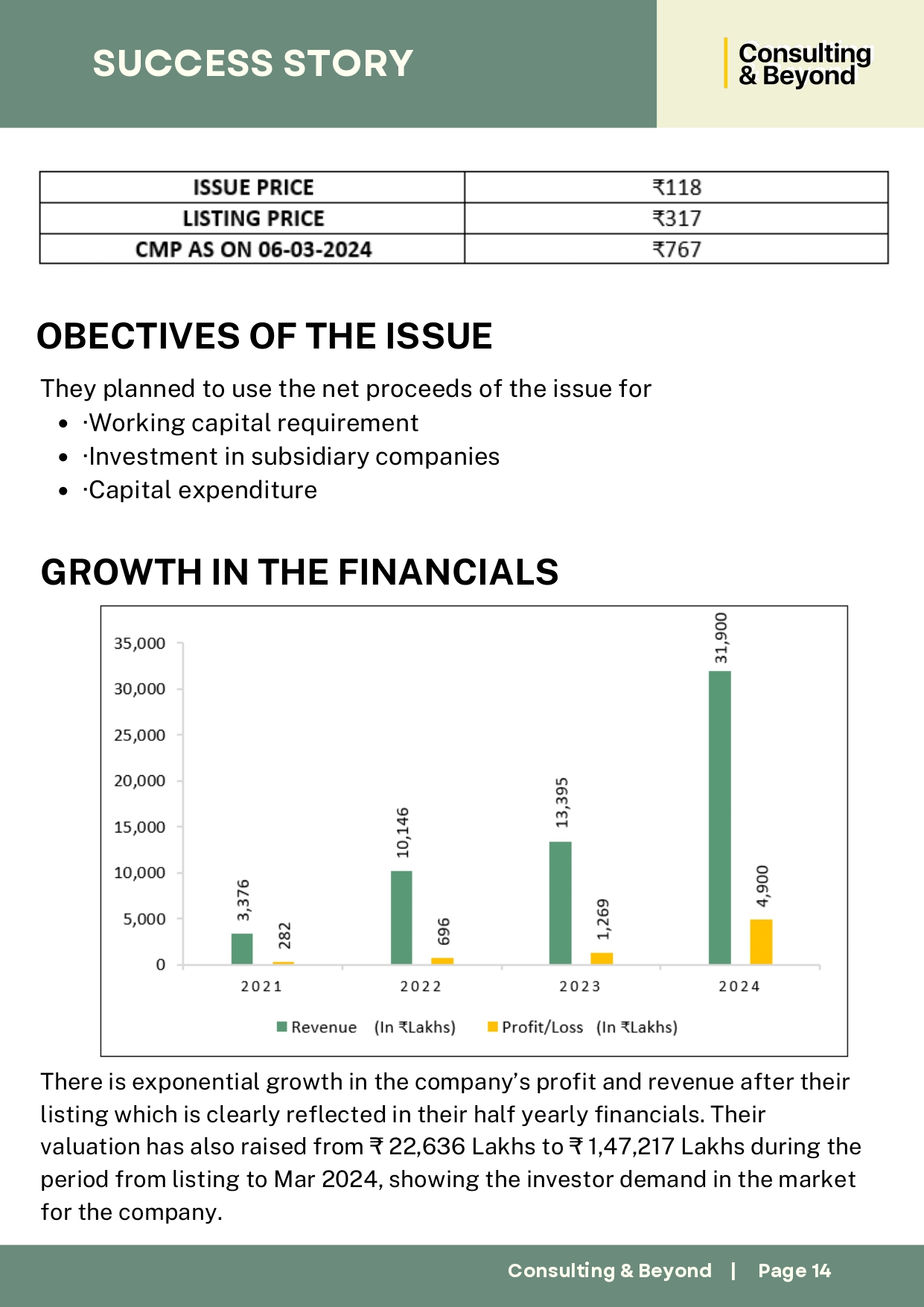

The report presents detailed market trends and growth data, including the number of SME IPOs over the years, top states for SME IPOs, and industry-wise valuation growth for companies that went public in 2021 and 2022. It also examines the market drivers fueling the demand for SME IPOs, such as investor demand, favorable economic conditions, high-growth potential, regulatory changes, and technological advancements.

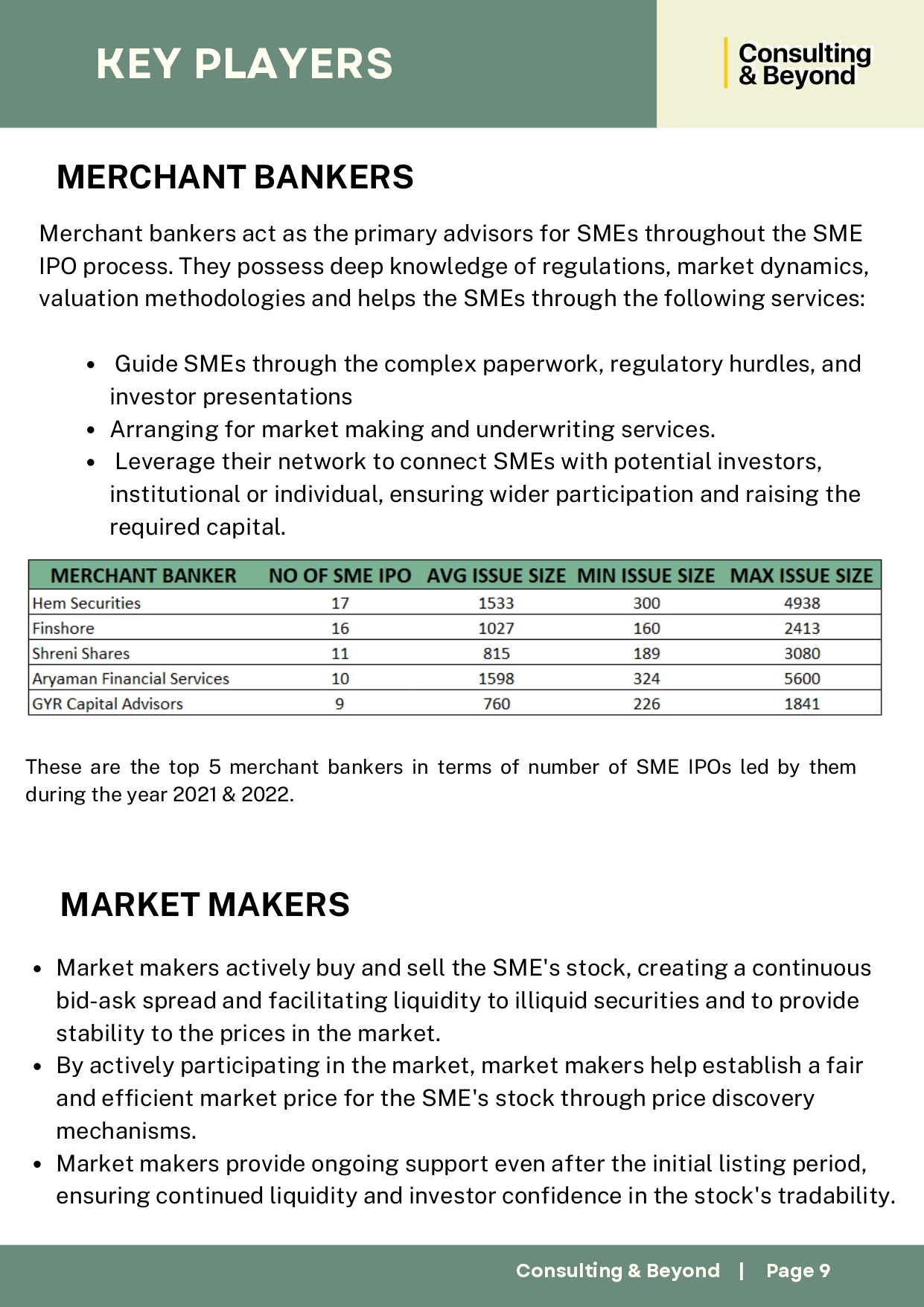

Furthermore, the report outlines the roles of key players in the SME IPO ecosystem, including the Securities and Exchange Board of India (SEBI), stock exchanges, merchant bankers, and market makers. It provides insights into the functions and responsibilities of these entities in facilitating and regulating SME IPOs.

The report also discusses the benefits and challenges associated with SME IPOs for both companies and investors. It highlights the advantages of access to capital, increased visibility, liquidity, and valuation benchmarks for companies, as well as the potential for high-growth potential, diversification, attractive valuations, and early-stage access for investors. However, it also acknowledges the challenges faced by companies, such as regulatory and compliance hurdles, financial constraints, and challenges for investors, including liquidity concerns, valuation issues, information asymmetry, and post-IPO performance risks.

Finally, the report offers a future outlook for the SME IPO market, highlighting the factors that support continued growth, such as the growing pool of potential issuers, increased liquidity in the market, continued investor interest in high-growth potential companies, and opportunities for diverse industries to participate in SME IPOs.

We thank Mr. Mukilan, Mr. Jeevan , Mr.Aditya and Mr.Selvamani of the Corporate Finance team for their invaluable contributions to the report.