More and more businesses now required to issue e-invoice

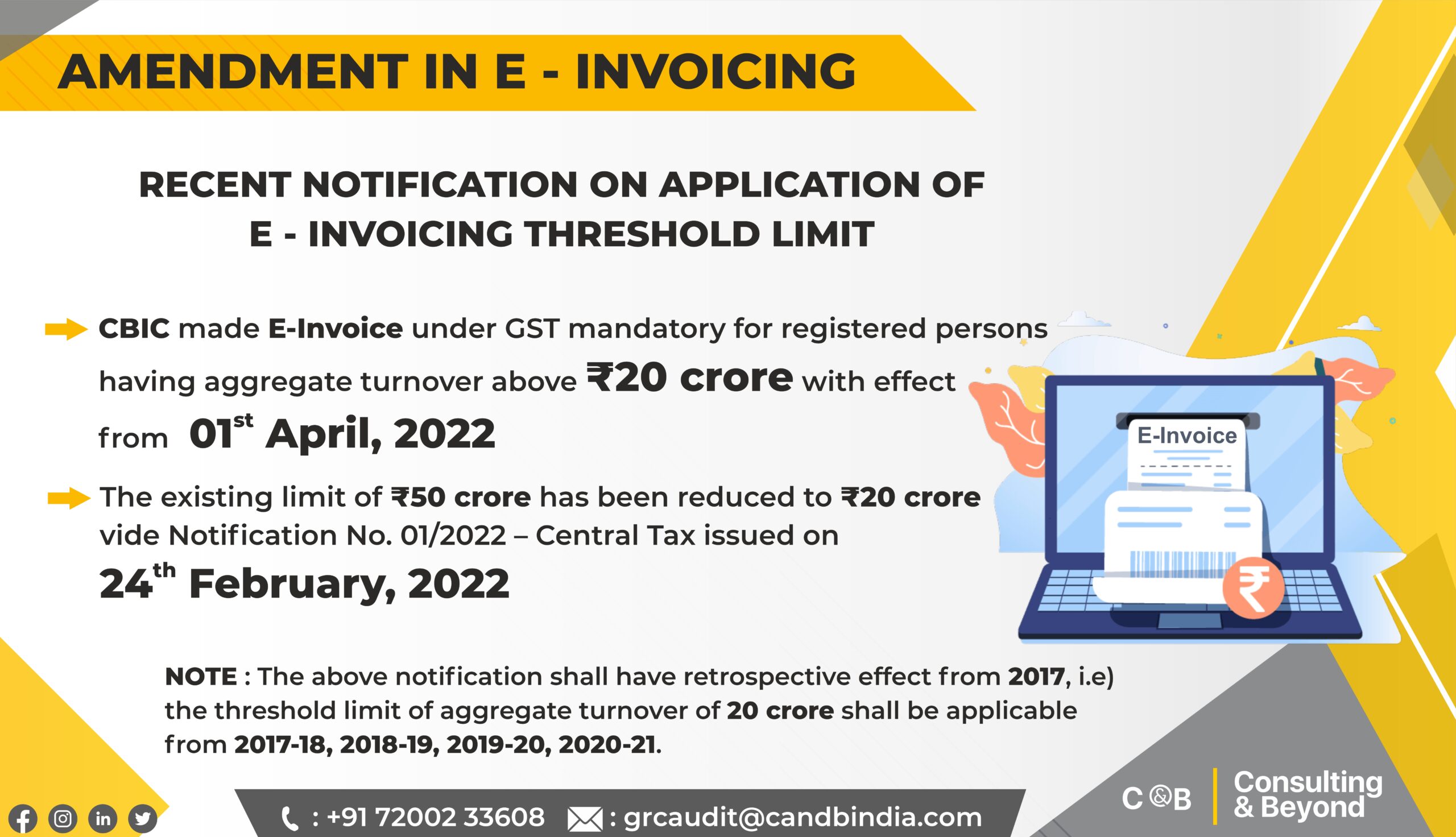

CBIC made E-invoice under GST mandatory for registered persons having aggregate turnover above ₹20 crore in any of the previous years from 2017-18 till 2021-22 with effect from 01st April, 2022. The existing limit of ₹50 crores has been reduced to ₹20 crores vide Notification No. 01/2022 – Central Tax issued on 24th February, 2022.

It means businesses with turnover of ₹20 crore or more will have to issue e-invoice from April 1. If the invoice is not valid, ITC (Input Tax Credit) on the same cannot be availed by the recipient, besides attracting applicable penalties.