Introduction

Do you know the value of your business? Surprisingly, many entrepreneurs do not take the time to measure the value and potential of their business annually.

You have worked hard to build this asset, and you should know the value of your hard work in the present and for the future. Most of us visit our doctor annually to get our vitals checked and prioritizing your business in this manner is just as wise. Not only do owners need to understand what their business is worth today, they also need to know what supports and drives that value.

Far too often, overconfidence or apathy causes this step to either be neglected or downplayed or at a minimum, based on incomplete data or conjecture. In this case, a valuation usually serves as a reality check for owners with an unbiased or informed viewpoint on what their business is worth. We have found that most business owners do not want to spend the resources (i.e., time and money) to hire a professional unless there is a need. And most often when there is a need to obtain feedback from an expert business appraiser, the time left to plan is too little for the transaction to complete.

Whereas the entrepreneurs who recognised the importance of business valuation and have valued their business are able to establish a baseline value for their business which enabled them to create more informed financial goals, business strategies and marketing objectives.

Here are the reasons you need a business valuation, whether you want to acquire a business, plan for succession or sell your company.

Reasons to get valuation

- Understand Your Current Business

- Understand Potential for Growth

- Plan Your Retirement/Exit strategy

- Ensure Proper Protection of Your Asset

- To Work With Lenders & Investors

- Mergers

- Litigation

- Buying a business

- Selling a Business

- Funding

- Selling a stake in business

- Decision making

- Granting stock options/ESOP

- Fairness opinions to support transactions

1.To understand your current business:

Valuation helps to create a baseline value for your company which lets you know where you stand in the marketplace and know how far your company has come since its inception and helps you understand how your company competes in the now.

When you measure this data, you can quantify it in a more meaningful way that motivates both you and your employees toward future growth.

2.To Understand Potential for growth:

A business valuation helps establish a baseline value which enables you to create more informed financial goals, business strategies and marketing objectives. Having current valuation of the business will give you good information that will help you make better decisions. Annual business valuations allow you to understand your company’s potential for growth and innovation.

3.Plan your retirement/Exit Strategy::

Nearing retirement age? Given thought to an exit strategy? Unfortunately, you cannot exit stage left and take a quick bow.

As with anything in business, you need a plan. Off the cuff decisions may mean that you end up rushing to close or sell your business and get less back than you put into your business. That is not fair to you, your employees or your business.

In instances where there is a plan to sell the business, it is wise to come up with a base value for the company and then come up with a strategy to enhance the company’s profitability so as to increase its value as an exit strategy. Your business exit strategy needs to start early enough before the exit. A valuation with annual updates will keep the business ready for unexpected and expected sales. It will also ensure that you have correct information on the company fair market value and prevent capital loss due to lack of clarity or inaccuracies.

4.Ensure Proper protection of your Asset:

Knowing the real value of your most prized asset allows you to protect it best. You need to protect your business as it operates, but life can also get ahead of you. You must protect your business in case of taxes, legal challenges, death etc.

5.To work with Lenders & Investors:

Your business may hit a rough patch. You may need an extra financial push to grow. Lenders often require a business valuation before signing off on loan, depending on the size and type of business. Specialized businesses may face more unique challenges in the economy and their respective markets, so values understandably shift. A business valuation helps the lender help you.

Banks may reduce your loan to value ratio if the state of your industry is uncertain or “shaky.” You might need to produce more security. Getting a business valuation now with an M&A advisory team helps when working with lenders.

6.Mergers:

A business valuation lets you know where you stand now and your company’s potential for growth, including developing strategies for future acquisitions. The value of the company is determined based on the purpose for which it is getting merged or acquired. The acquirer will want to purchase the target at the lowest price, while the target will want the highest price. Thus, valuation is an important part of mergers and acquisitions (M&A), as it guides the buyer and seller to reach the final transaction price.

A business valuation helps a company determine its next move. Business owners finding themselves at a crossroads in growth or retirement can seek the assistance of experienced M&A advisers to appraise the company and strategize for the future.

7.Litigation:

During court case, where there is an issue with the value of business, you may need to provide proof of your company’s worth so that in case of any damages, they are based on the actual worth of your business and not inflated figures estimated by a lawyer.

8.Buying a business:

Even though sellers and buyers usually have diverse opinions on the worth of the business, the negotiation starts with what the buyers are willing to pay. A good business valuation will look at market conditions, potential income, and other similar concerns to ensure that the investment you are making is viable.

9.Selling a business:

When you want to sell your business or a company to a third party, you need to make certain that you get what it is worth. The asking price should be attractive to prospective purchasers, leaving little money on the table for the deal to be attractive.

10.Funding:

An objective valuation is needed when you need to negotiate with potential investors for funding. Professional documentation of your company’s worth is usually required since it enhances your credibility to the lenders.

11.Selling a stake in business:

For business owners, Proper business valuation enables you to know the worth of your shares and be ready when you want to sell them. Just like during the sale of the business, you ought to ensure no money is left on the table and that you get good value from your share.

12.Decision making:

An owner may want a business appraisal to help decide the near- and long-term strategies. While the investment in an appraisal is meaningful and not undertaken lightly, an owner at an inflection point in the business or his/her personal life may need the information to decide whether to sell, expand, gift, strategically plan or go in another direction. It may be an action that leads to growth and future success (business and personal).

13.ESOP:

An employee stock ownership plan (ESOP) is an employee benefit plan that invests in employer common stock. ESOPs provide capital, liquidity, and certain tax advantages to those private businesses whose owners do not wish to go public.

A valuation must be performed annually for an ESOP. This valuation determines the price per share for the beneficiaries of the ESOP plan. ESOP accounting valuation is required upon grant of options for booking compensation expenses by the company and ESOP perquisite tax valuation is required upon exercise of option by employees under income tax law.

14. Fairness opinion to support transactions:

When you are negotiating a merger, negotiating a management buyout, undertaking certain types of corporate reorganizations, tax planning as well as legal contracts requiring a value to be set on your business or business interest. A fairness opinion involves a total review of a transaction from a financial point of view. The advisor (e.g., investment bank, business appraiser) examines the pricing, terms and consideration received in the context of the market for similar companies. The advisor opines that the transaction is fair, from a financial point of view and from the perspective of minority shareholders.

In addition to these, you are required by several statutes to get your business valued for specified reasons.

15.Regulatory reasons to get valuation:

SEBI:

Under SEBI directive, a valuation report of valuer is required in case of court/Tribunal approved scheme of arrangement/amalgamation involving listed companies.

Also, valuation report is needed for determination of value of shares under takeover code/Preferential allotment/Exit opportunity/Delisting etc.

FEMA:

Under FEMA laws (FDI), for issue/transfer of equity shares/compulsory convertible instruments between Resident and Non-Resident valuation is required. Also, valuation is required for investment/Acquisition of companies outside India.

Income tax act:

- ESOP Accounting valuation is required upon grant of options for booking compensation expenses by company and ESOP perquisite tax valuation is required upon exercise of option by employees.

- For issue/Transfer of shares between Residents (Gift tax) & transaction between associated enterprises requires valuation for transfer pricing.

Companies Act:

| S.No | Relevant section and type of Valuation | Type of Issue |

| 1 | Section 42 read with Rule 12(5) of the companies (Prospectus of securities) Rules, 2014 Valuation of the consideration against which securities are issued | Private Placement of securities for consideration other than cash. |

| 2 | Section 62(1)(c ) read with Rule 13 of the companies (Share capital and Debentures) rules 2014, Valuation of the Price of shares which are being issued | Preferential Issue of further shares. |

| 3 | Section 52 read with Rule 8 of the companies (Share capital and Debentures) rules, 2014 Valuation of intellectual property rights or know how or value additions for which sweat equity shares are to be issued | Issue of sweat equity shares to directors/employees at a discount or for consideration other than cash. |

| 4 | Rule 2(ix) of the companies (Acceptance of Deposits) rules, 2014 Assessment of market value of such assets | Amount raised by the issue of bonds or Debentures secured by a first charge or a charge ranking pari passu with the first charge on any assets referred to in schedule III of the act excluding intangible assets of the company. |

| 5 | Section 192 Valuation of Assets involved | Arrangement with a Director of the company, its holding, subsidiary or Associate company or any person connected with him for acquisition of assets for consideration other than cash. |

| 6 | Section 230(2)(C )(V) | Valuation report in respect of the shares and the property and all assets, tangible and intangible, movable and immovable, of the company under the scheme of corporate Debt restructuring. |

| 7 | Section 230(3) & 232(2)(d) | In case of a compromise or arrangement between members or with creditors, a valuation report in respect of shares, Property or Assets, tangible and intangible, movable and immovable of the company, or a swap ratio report. |

| 8 | Section 232(2)(h) | Under the scheme of compromise/Arrangement in case the transferor company is Listed company and the transferee company is an unlisted company – Valuation report is required to be made by the tribunal for exit opportunity to the shareholders of the transferor company. |

| 9 | Section 236(2) | For valuing equity Shares held by Minority Shareholders. |

| 10 | Section 281(1)(a) | For Valuing Assets for submission of report by company liquidator. |

| 11 | Section 305(2)(d) | For report on the assets of the company for preparation of declaration of solvency under voluntary winding up. |

| 12 | Section 319(3)(b) | For valuing the interest of any dissenting members of the transferor company in case of liquidation. |

Overview of Valuation:

The assessment of value is indeed an art form as much as it is a science. Business valuation is a process and a set of procedures used to estimate the economic value of an owner’s interest in a business. An accurate valuation of a closely held business is an essential tool for a business owner to assess both opportunities and opportunity costs as they plan for future growth and eventual transition. It provides either a point-in-time assessment of relative value for an owner, or perhaps the price a buyer would be willing to acquire the business.

On its face, business valuation is actually a relatively simple and straightforward concept. A qualified professional first analyses the subject company’s financial statements and considers comparable transactions, industry ratios and other quantitative and qualitative information. Then, applicable adjustments are made to align the subject company to an industry standard or benchmark. Despite the benefits, however, many business owners are apprehensive about what to expect when going through the valuation process. In some cases, valuations can expose areas of the business which actually take away from value, such as weak financial and accounting controls, under-performing assets and weaker operating ratios relative to its peer group. The entire valuation process can provide an overview of strengths and weaknesses of the reviewed company.

Key considerations for business Valuation:

In our country, Valuation in itself is evolving. The business valuation professional will first consider the purpose and objective of the valuation. They will then look at the nature and background of the business, its products and services, as well as the industry life cycle, economic and political environment. Unique factors are then considered, including customer relationships, executive compensation, as well as excess assets, working capital, and liabilities.

Considerations which could have a profound influence on value include goodwill or other intangible assets, the dependency on an owner or key employee(s), diversity of the customer base, market position and the competitive landscape of the industry.

There are three widely accepted fundamental methods used in valuing closely held business interests, the asset, income, and market approach. The methods most useful in determining final value will depend on several factors, including the purpose of the valuation and the type of company being valued.

Team & Qualifications:

Rathandeep Umesh, MBA Finance

Founder & CEO, Consulting and Beyond

Highly dedicated professional believing that the profession is all about continuous learning, commitment and adding value to all stakeholders. Successfully heading Corporate Finance division at C&B Management Consulting and specializing in providing advisory services for small and medium scaled organizations for more than a decade and half. She is very keen and inclined on valuing companies, providing insights on improving profitability, providing directions on managing cash flows in pursuit of making businesses cash-rich. Her qualifications are

- Executive program on applied finance – IIM Calcutta

- Master of Business Administration (MBA), Finance – ITM

- Advanced Valuation – Stern school of Business, New York university

- Qualified as an Independent Director in companies in India – Under Indian institute of Corporate Affairs (IICA under MCA)

- Registered Valuer – Insolvency and Bankruptcy Board of India

Her areas of contribution include Generating Consensus in decision making, Financial Opinion on significant strategies including M & A, Sales.

Services offered:

- Purchase price allocation

- Share based payments

- Shares & Intangible assets

- Valuation of IP and other Intangible assets

- Fairness opinions

- Valuation opinions and advice in restructuring contexts

- Valuation and modelling services to support transactions & restructuring

- Valuation for Statutory compliance under the income tax act

- Valuation for Statutory compliance under various corporate laws including companies act

Why choose us?

- Valuation report delivered in optimum time

- Highest quality results with multi-dimensional valuation approach

- Personal interaction with every client

- Continuous working with client’s business requirements.

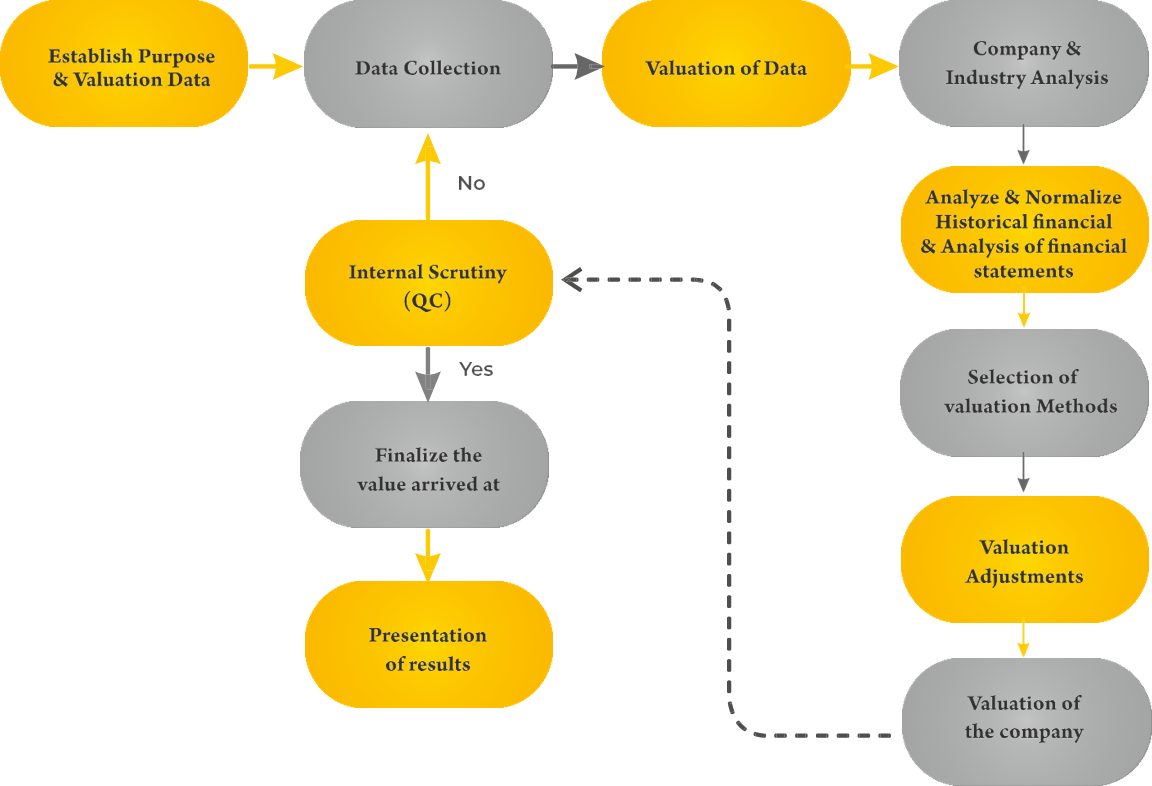

Process flow of work:

Deliverables:

A detailed valuation report and further collaboration is done with merchant bankers for funding.